Reforms soften blow of Europe's banking crisis but risks remain

Xinhua

25 Mar 2023, 02:14 GMT+10

According to Lorenzo Rocco from the Department of Economics and Management at the University of Padova, it is unlikely that Credit Suisse will be the last large European bank to fall under pressure during the current crisis.

ROME, March 24 (Xinhua) -- Financial sector reforms put into place in the wake of the global financial crisis 15 years ago have so far helped protect European banks from being hit harder by the ongoing banking crisis, analysts said. But the latest round of problems have still not fully run their course.

European stock markets have just ended their second consecutive week of high volatility. On Friday, the week's final session, shares were mostly lower, with the blue-chip indexes in Paris and Frankfurt down 1.7 percent each, while in Milan shares slipped by 2.2 percent, and in Amsterdam they retreated by 1.6 percent.

Over the past ten sessions, European shares broadly fell seven times, with banking sector stocks the main reason for the ups and downs.

The current banking sector fragility was sparked by the collapse of two regional banks in the United States -- Silicon Valley Bank in California and New York's Signature Bank. Soon after, Switzerland's Credit Suisse shed nearly a quarter of its value in one day, March 15.

But markets were called earlier this week when UBS, Credit Suisse's main rival, acquired the troubled lender for around 3 billion U.S. dollars.

According to Lorenzo Rocco from the Department of Economics and Management at the University of Padova, it is unlikely that Credit Suisse will be the last large European bank to fall under pressure during the current crisis.

"We might still see large consequences for other banks," Rocco told Xinhua. "All banks these days are interconnected and ... the more the waves spread across the banking sector the more we could see trouble."

Andrea Giuricin, a professor of finance and mobility management at Bicocca University in Milan, pointed out that the current situation is the latest in a series of crises, including the global crisis of 2008-2009 sparked by the collapse of U.S.-based giant Lehman Brothers and regional crunches like the one in 2012-2013 that had wide-ranging impacts on Spanish banks. The coronavirus pandemic also had big impacts on financial institutions.

"Europe already had big problems with its banks," Giuricin told Xinhua.

But both Rocco and Giuricin said that reforms put in place over the past decade and a half are paying dividends this time around.

"At the European level we now have a system that's a little stricter than it had been," Giuricin said. "There are still risks for the weaker banks, and tension is still there. But now we've been through rounds of consolidation that resulted in bigger banks acquiring smaller and more vulnerable banks. Banks are required to have more liquidity than they did before, and the internal capital for banks is higher."

Rocco agreed, adding that since top-tier banks cannot hold the bonds of other top-tier banks, that reduces the risk of contagion through the sector.

Rocco also said the current crisis is furthering the kind of consolidation the sector has been going through.

"UBS made the deal of a lifetime when it acquired Credit Suisse," he said. "They paid 3 billion U.S. dollars for a bank that had been worth 8 billion U.S. dollars just before, so they paid less than half price, and they did it with a guarantee of the Swiss Central Bank, and while doing it they basically eliminated their largest competitor."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Tucson Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Tucson Post.

More InformationBusiness

SectionGold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

BP appoints ex-Shell finance chief Simon Henry to board

LONDON, U.K.: This week, BP appointed Simon Henry, former Shell finance chief, to its board as a non-executive director effective September...

Arizona

SectionAmazon adds Kevin Harlan, analysts to NBA broadcasts

(Photo credit: Mark J. Rebilas-Imagn Images) Amazon Prime Video has hired veteran broadcaster Kevin Harlan to call NBA games during...

Reports: Amazon adds Kevin Harlan, analysts to NBA broadcasts

(Photo credit: Mark J. Rebilas-Imagn Images) Amazon Prime Video has signed Kevin Harlan to call NBA games in the 2025-26 season,...

D-backs hope to continue strong starting pitching vs. Padres

(Photo credit: Arianna Grainey-Imagn Images) The Arizona Diamondbacks are under .500 for a good reason: Their starting pitching hasn't...

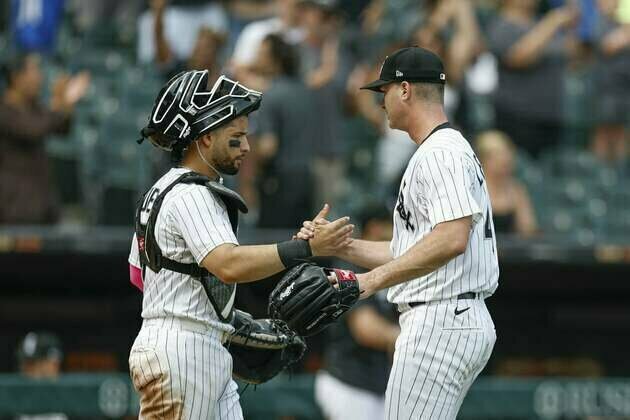

MLB roundup: White Sox halt Blue Jays' 10-game winning streak

(Photo credit: Kamil Krzaczynski-Imagn Images) Adrian Houser allowed one run over seven innings to help the Chicago White Sox end...

Geraldo Perdomo's slam sends Diamondbacks past Padres

(Photo credit: Denis Poroy-Imagn Images) Geraldo Perdomo hit a grand slam Wednesday night and Brandon Pfaadt sailed through the longest...

Rebecca Allen's hot shooting gives Sky season sweep of Wings

(Photo credit: Kamil Krzaczynski-Imagn Images) Rebecca Allen scored 27 points and Angel Reese notched a double-double with 15 points...