Rand weaker after 'hawkish' US rate cut

News24

19 Sep 2019, 11:43 GMT+10

The Federal Reserve cut interest rates for the second straight meeting, but projections for the path of policy diverged, leaving equity markets on edge.The central bank lowered rates 25 basis points, noting that trade policy and slowing global growth warranted the cut even as the US economy remains strong. Officials split on the need for further easing, with five seeing no change in rates by the end of the year, five wanting one more cut and seven expecting two cuts.

The rand - ahead of an interest rate decision from the SA Reserve Bank on Thursday - was weaker on Thursday morning. It usually benefits from a US rate cut, as it leaves the yield on the local currency looking more appealing.

The rand was last at R14.71/$ from R14.66 overnight.

Here's what investors had to say:

Peter Boockvar, chief investment officer at Bleakley Advisory Group:

"There is now a likelihood that as of today, this might be the last rate cut of the year as the 'mid-course adjustment' process continues but could be done. So call this a hawkish cut. The stock market is of course disappointed with the limit on the amount of candy they'll get but more rate cuts assumes an ever slowing economy and that's not something to cheer for."

Zhiwei Ren, Penn Mutual Asset Management portfolio manager:

"There was some speculation they might increase the balance sheet by about $150 billion a year to provide liquidity for the market. They didn't mention that. That's taken as a little bit hawkish -- a tiny little bit hawkish. Other than that, everything's as expected," Ren said. "The median is for no more cuts after this one, but there are seven members that think there's one more cut for the rest of the year. That means they're leaning towards one more cut for the rest of this year. But for 2021, they see one hike -- one rate hike. That fits into the rhetoric that this is a mid-cycle adjustment. That's what they're indicating. That they'll cut and then hike again."

Marvin Loh, global macro strategist at State Street:

"There's a decent amount of dissent or differing opinions within the FOMC at this point," Loh said. "The dispersion of opinions around the next two years seems like it's one of the main stories that the market's going to take away. We have a stronger dollar, the curve is flattening. It's the market saying that the FOMC is hawkish, so the dollar is stronger, curve is flattening, so we've got policy mistakes built into there."

David Page, head of macroeconomic research at AXA Investment Managers:

"To some extent, markets were hoping to see a little bit more from the Fed. Markets do price a bit more and particularly after some of the excitement that we'd seen again in the short-term funding markets, they may have expected to see movement on the balance sheet. What we're seeing is perhaps a little bit of disappointment that the Fed rate wasn't moved lower by more than 25 basis points, but also possibly that some has possibly started to assume the Fed would start to let the balance sheet rise a little bit again."

Mike Loewengart, vice president of investment strategy at E*TRADE Financial:

"There isn't too much new to digest in today's Fed announcement, although it's interesting to see an increasingly divided Fed. Their accommodative stance comes at a time of conflicting economic signals. While unemployment is near a 50-year low and consumers continue to ramp up spending, manufacturing output has slowed, job gains have tapered, trade tensions have stressed the economy, and the yield curve has inverted. With inflation still short of the Fed's sweet spot and bond yields hinting at an economic slowdown, the Fed may not be done cutting rates this year."

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Tucson Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Tucson Post.

More InformationBusiness

SectionEx-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...

BRICS issues rebuke on trade and Iran, avoids direct US criticism

RIO DE JANEIRO, Brazil: At a two-day summit over the weekend, the BRICS bloc of emerging economies issued a joint declaration condemning...

Arizona

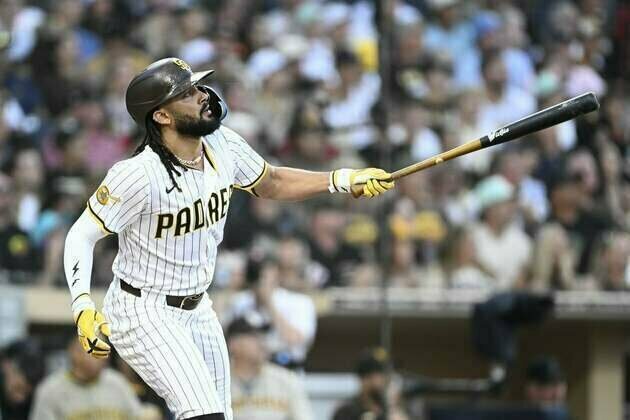

SectionFernando Tatis Jr., Manny Machado power Padres past D-backs

(Photo credit: Denis Poroy-Imagn Images) Fernando Tatis Jr. and Manny Machado each homered as the San Diego Padres beat the visiting...

Amazon adds Kevin Harlan, analysts to NBA broadcasts

(Photo credit: Mark J. Rebilas-Imagn Images) Amazon Prime Video has hired veteran broadcaster Kevin Harlan to call NBA games during...

Reports: Amazon adds Kevin Harlan, analysts to NBA broadcasts

(Photo credit: Mark J. Rebilas-Imagn Images) Amazon Prime Video has signed Kevin Harlan to call NBA games in the 2025-26 season,...

D-backs hope to continue strong starting pitching vs. Padres

(Photo credit: Arianna Grainey-Imagn Images) The Arizona Diamondbacks are under .500 for a good reason: Their starting pitching hasn't...

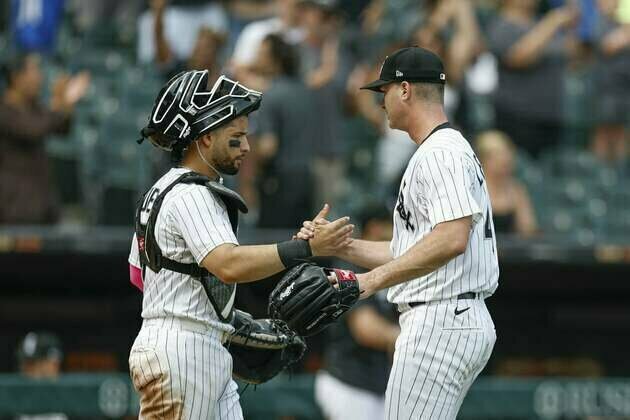

MLB roundup: White Sox halt Blue Jays' 10-game winning streak

(Photo credit: Kamil Krzaczynski-Imagn Images) Adrian Houser allowed one run over seven innings to help the Chicago White Sox end...

Geraldo Perdomo's slam sends Diamondbacks past Padres

(Photo credit: Denis Poroy-Imagn Images) Geraldo Perdomo hit a grand slam Wednesday night and Brandon Pfaadt sailed through the longest...